Traditional Banking in 2025: The Rise of MyDove

Traditional Banking

As we head into 2025, the world is witnessing a fundamental shift in how we manage and move our money. The traditional banking system, long seen as the cornerstone of personal finance, is now facing stiff competition from fintech companies that offer innovative, faster, and more affordable financial solutions. Among these emerging fintech platforms, MyDove – a cutting-edge fintech app, is leading the charge in providing seamless, secure, and cost-effective payment services to Nigerians, especially within the Gen Z bracket.

In this post, we’ll explore why fintech is outpacing traditional banking, and how MyDove stands at the forefront of this revolution. From offering instant global money transfers to providing the best Christmas money transfer deals in 2024, fintech apps like MyDove are reshaping how we think about financial transactions. Let’s dive into the reasons why fintech trumps traditional banking in 2025.

1. Speed and Convenience: The Age of Instant Transactions

One of the most significant advantages fintech has over traditional banking is speed. With digital wallets like MyDove, users can send money globally fast, ensuring funds are transferred instantly, no matter where they are in the world. This makes fintech an especially attractive option during time-sensitive occasions like the New Year celebrations, when you want to send money to loved ones in a matter of minutes.

Traditional banks, on the other hand, typically take much longer for cross-border transfers, sometimes up to several business days. In addition, many banks charge extra fees for international transfers, making them less competitive compared to fintech platforms like MyDove, which offer instant global money transfers with low fees.

With fintech apps like MyDove, you can perform easy online remittances with just a few taps on your phone, eliminating the need to visit a bank branch or stand in long queues. This level of convenience is particularly appealing to younger generations, who are more accustomed to hassle-free money transactions and want to handle their finances on-the-go.

2. Lower Fees: More Affordable Cross-Border Payments

Fintech is redefining how we think about fees. Traditional banks charge hefty fees for international money transfers, with additional charges for exchange rates, service fees, and hidden costs. MyDove, however, offers affordable cross-border payments, providing users with a transparent and competitive fee structure that ensures they get the best value for their money.

For example, if you’re sending money to Nigeria or the USA, traditional banks may impose extra charges, which can add up quickly. With MyDove’s secure transfer technology, you can transfer money worldwide with low fees and avoid the surprise costs associated with conventional banking. This makes fintech an ideal option for those looking for the best alternatives to Western Union for online transfers, especially when sending funds for personal occasions like the best Christmas money transfer deals in 2024.

Moreover, fintech apps generally offer better exchange rates than traditional banks, allowing users to get more value from their money when transferring across borders. This aspect is crucial, especially in countries like Nigeria, where exchange rate fluctuations can affect the value of money being transferred.

3. Security: The Safest Platform to Send Money Online

When it comes to financial transactions, security is a top priority. Traditional banks have established security measures in place, but in today’s digital world, fintech companies like MyDove are implementing even more advanced security protocols to protect users from fraud and cyber threats.

MyDove uses end-to-end encryption, multi-factor authentication, and other security measures to ensure that all transactions are safe and secure. This makes it one of the safest platforms to send money online, offering users peace of mind when transferring funds or making payments. Furthermore, fintech platforms like MyDove regularly update their security systems to stay ahead of evolving cyber threats, which often surpasses the security capabilities of traditional banks.

For individuals looking to send money instantly for New Year celebrations or handle easy online remittances, knowing that their funds are being transferred securely is essential. With MyDove, users can trust that their money will reach its destination without any security breaches or delays.

4. Global Accessibility: Transfer Money Worldwide with Ease

Unlike traditional banks, which often have geographic limitations, fintech platforms like MyDove allow users to transfer money worldwide with ease. Whether you’re sending money to Nigeria, the USA, or any other country, fintech platforms provide access to a secure online money transfer platform that works seamlessly across borders.

In 2025, as the world becomes more interconnected, the ability to send money quickly and securely across borders is becoming more essential. Fintech apps like MyDove are leading the way in this regard, providing users with the ability to send money globally fast to anyone, anywhere, without the need for intermediary banks or costly service charges.

5. User-Friendly Interfaces: The Future of Financial Management

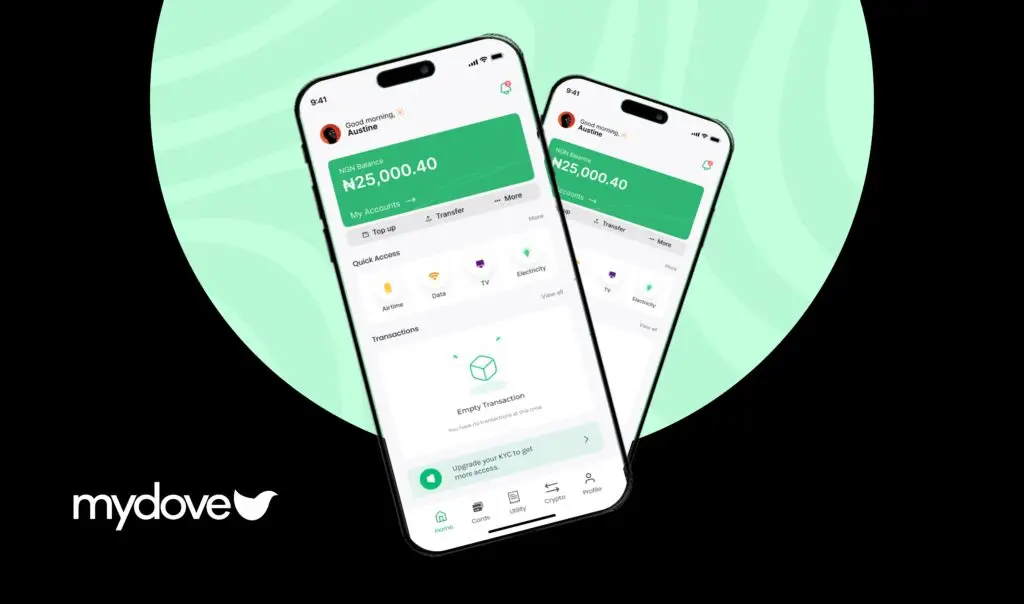

One of the key reasons why fintech trumps traditional banking is the user experience. Fintech apps are designed with the end-user in mind, offering intuitive, easy-to-use interfaces that cater to a wide range of users. For Gen Z, who are digital natives, the need for a seamless experience is paramount. Traditional banking apps, while functional, are often clunky and outdated, requiring users to navigate through complex steps to perform basic transactions.

In contrast, MyDove and other fintech apps offer streamlined, hassle-free money transactions. The interface is designed to be simple and efficient, making it easy for users to manage their finances and send money internationally, whether for personal or business purposes. Whether you’re looking to shop online in Nigeria, transfer money to a family member abroad, or take advantage of the best international money transfer service, fintech apps like MyDove ensure that the process is smooth and straightforward.

6. Innovation and Adaptability: Latest Digital Payment Solutions

Fintech companies are also more adaptable and willing to innovate than traditional banks. The financial landscape is rapidly changing, and fintech apps are at the forefront of offering the latest digital payment solutions in Nigeria and beyond. From instant global money transfers to new payment methods and cryptocurrency integration, fintech platforms like MyDove are constantly evolving to meet the needs of modern users.

In contrast, traditional banks often take longer to adopt new technologies and services, making them slower to respond to customer demands. As we move into 2025, fintech’s ability to quickly adapt to new technologies will continue to set it apart from traditional banking services.

Conclusion: The Future Is Fintech

In 2025, fintech is poised to continue its rapid growth, outpacing traditional banking services in terms of speed, convenience, and affordability. Platforms like MyDove are redefining the way we think about financial transactions, offering users the ability to send money globally fast, transfer money worldwide with low fees, and enjoy a seamless, secure experience.

Whether you’re looking for affordable cross-border payments, the best alternatives to Western Union for online transfers, or instant global money transfers, fintech platforms like MyDove provide solutions that are faster, more secure, and more cost-effective than traditional banks.

As the world moves towards a more digital-first economy, embracing fintech is not just a trend – it’s the future of managing money. If you’re ready to experience easy online remittances, secure online money transfers, and the convenience of digital wallets, MyDove is here to make your financial transactions simpler, safer, and more affordable. Join the fintech revolution today!